Mandates

-

How Federal Budget Reconciliation Proposals Threaten New York’s Counties

How Federal Budget Reconciliation Proposals Threaten New York’s CountiesNYSAC has released a new report that outlines the projected financial and service impacts of proposed federal cuts to Medicaid, SNAP, and other core programs that counties help deliver every day.

-

2025 Legislative Session Summary

2025 Legislative Session SummaryOur annual Legislative Session Summary report detailing those bills that may have an impact on county government operations.

-

2024 Legislative Summary

2024 Legislative SummaryRead our comprehensive report of legislation with county impact that has passed both houses of the State Legislature

- Agriculture & Rural Affairs

- Children with Special Needs

- Demographic and Economic Reports

- Economic Development

- Human Services

- Intergovernmental Affairs

- Mandates

- Medicaid

- Public Health

- Public Safety

- Taxation and Finance

- Transportation & Infrastructure

- Veterans' Affairs

- Climate, Environment & Energy

- Mental Health

-

End of Session County Priorities

End of Session County PrioritiesCounty priorities for the remaining days of the 2024 Legislative Session.

-

SFY 2025 Enacted State Budget Impact Report

SFY 2025 Enacted State Budget Impact ReportDetailed analysis of the county impact of the SFY 2025 State Budget.

-

SFY 2025 One House Budgets County Impact Report

SFY 2025 One House Budgets County Impact ReportNYSAC's analysis of the SFY 2025 Senate and Assembly Budget proposals.

-

The Hidden County Costs that Fund the State’s Growing Spending Plans

The Hidden County Costs that Fund the State’s Growing Spending PlansSince the 1960’s, the State of New York has relied on local tax revenues as a piggy bank to fund programs and services.

-

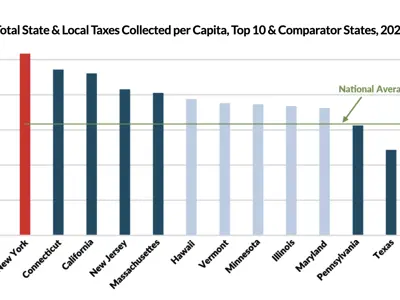

Latest Research on NY’s Highest-in-the-Nation Taxes

Latest Research on NY’s Highest-in-the-Nation TaxesCitizens Budget Commission (CBC) report examines how state mandates contribute to NY's rank as highest taxed state.

-

NYSAC Releases SFY 2025 Executive Budget Impact Report

NYSAC Releases SFY 2025 Executive Budget Impact ReportEach year, NYSAC publishes an Executive Budget impact report, highlighting the areas of the Governor’s Executive Budget proposal impacting county governments

-

2024 State of the State Summary

2024 State of the State SummaryAnalysis of Governor Hochul's 2024 State of the State address.

Contact Us

New York State Association of Counties

515 Broadway, Suite 402

Albany, NY 12207

Phone: (518) 465-1473

Fax: (518) 465-0506